Comparative Analysis of Interest Rate and Annual Percentage Yield (APY):Understanding the Difference

Updated: 18 Jul 24

63

In this article, we will cover the difference between an Comparative Analysis of Interest Rate and Annual Percentage Yield (APY) deposit in detail. The interest rate refers to the percentage at which interest is earned on the original amount of money deposited or invested, without accounting for any interest that has been added over time. On the other hand, the annual percentage yield (APY) takes into account the effects of compounding, reflecting the total amount of interest earned on both the original principal and the accumulated interest over the course of one year. APY provides a more accurate measure of the real return on an investment or savings account.

Comparative Analysis of Interest Rate and Annual Percentage Yield:

| Feature | Interest Rate | Annual Percentage Yield (APY) |

| Definition | The percentage earned on the original amount. | The percentage that includes interest on the original balance and compound interest over one year. |

| Compound Interest | Does not include compound interest. | Includes compound interest. |

| Calculation Basis | Based solely on the initial principal. | Based on both the initial principal and the accumulated interest. |

| Reflection of Earnings | Reflects only the interest earned on the principal. | Reflects the total interest earned, including interest on interest. |

| Representation | Simplified view of the interest earned. | Accurate measure of the real return on an investment or savings account. |

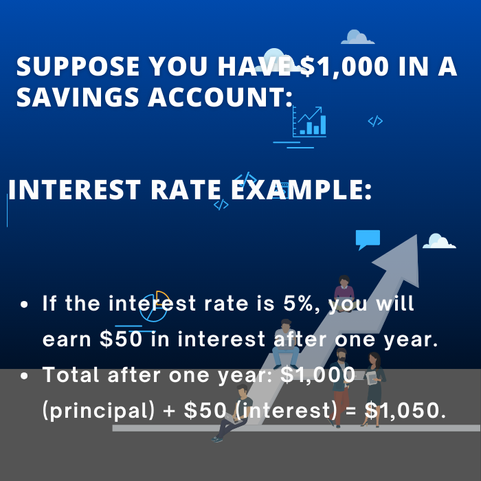

What is an interest rate?

The interest rate is the simple rate of return you earn on your money in a deposit account. The interest rate refers to the simple rate of return earned on the original amount (principal) deposited in a financial account or investment. It is calculated as a percentage of the principal over a specific period, typically one year, without taking into account any interest that accumulates over time.

What are the benefits of the interest rate?

- Interest rates are easy to understand.

- Interest rates provide a standard measure for comparing the returns on different financial products, such as loans, savings accounts, and investments.

- Interest rates can be adjusted by central banks or financial institutions to control inflation, stimulate economic growth, or respond to market conditions.

What are the challenges of interest rate?

- Interest rates do not account for the effects of compounding, which can result in a discrepancy between the stated rate and the actual amount earned or paid over time.

- Interest rates may not capture all the costs associated with borrowing or all the benefits of saving. Additional fees, compounding frequency, and other factors can impact the overall returns.

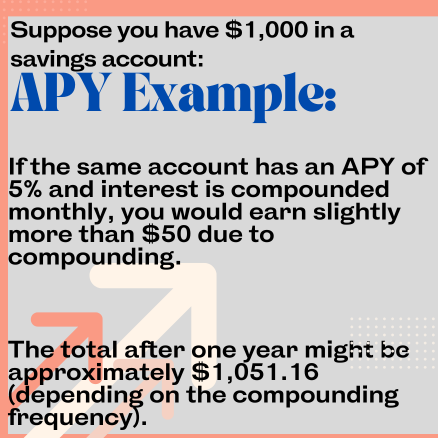

What is an annual percentage yield (APY)?

Annual Percentage Yield (APY) is a metric used to express the total interest earned on a deposit account, investment, or loan within a one-year timeframe, incorporating compound interest. It includes all interest accrued throughout the year, including the interest earned on both the initial principal amount and any previously accumulated interest. APY provides a comprehensive depiction of the overall return or cost associated with a financial instrument, factoring in the compounding effect that amplifies earnings or expenses over time.

What are the Benefits of Annual Percentage Yield (APY)?

- APY takes into account the effects of compounding, providing a more accurate representation of the total amount earned or paid over a specific period.

- APY allows for easy comparison of the annualized returns on different savings products, including savings accounts, certificates of deposit (CDs), and money market accounts.

- APY calculation is standardized across financial products, making it easier for consumers to understand and compare the potential returns on their savings.

What are the Challenges of Annual Percentage Yield (APY)?

- APY calculations can be more complex than simple interest rates, especially when considering compounding frequency and other factors. This complexity may make it harder for consumers to understand the true value of their savings.

- APY can lead to misleading comparisons between financial products. For example, a high APY on a savings account may be accompanied by other restrictions or fees that reduce the overall returns.

FAQs about Interest Rate and Annual Percentage Yield:

What’s the difference between Interest Rate and Annual Percentage Yield?

The key disparity lies in their treatment of compound interest. Interest rate reflects the simple return on the initial principal, excluding compounding effects. Conversely, APY incorporates compound interest, considering both the initial principal and any accrued interest, offering a more comprehensive depiction of the actual return on an investment or deposit.

Why is annual percentage yield (APY) higher than the interest rate?

APY tends to be higher than the stated interest rate because it accounts for compound interest. With compound interest, the interest earned on the initial deposit accrues over time and is added to the principal, resulting in interest being earned on the interest itself. This compounding effect amplifies the overall return, making the APY higher than the simple interest rate.

Interest Rate and Annual Percentage Yield which is best for the economy?

Both interest rates and APY serve critical functions in the economy, and their optimal levels depend on various economic factors and policy objectives. Maintaining a balance between them is essential for promoting sustainable economic growth, managing inflation, and ensuring financial stability.

Conclusion:

Interest rates provide a simple and transparent measure of the cost of borrowing or the return on savings, APY offers a more comprehensive view by accounting for compounding. However, the complexity of APY calculations and the potential for misleading comparisons highlight the importance of careful consideration and financial literacy when evaluating savings options.

Ultimately, the best choice is the one that aligns with your needs and situation. If you have any questions or need further guidance, feel free to leave a comment or reach out!

Please Write Your Comments