Key Differences Between Debit Card and Credit Card:

Updated: 12 Jul 24

91

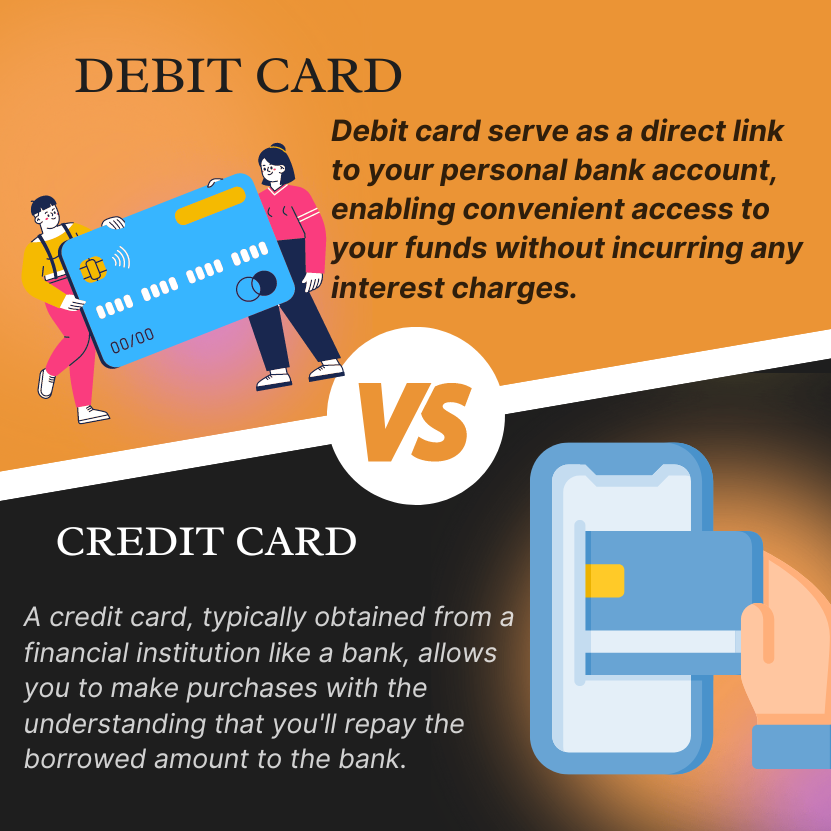

In this article, we will explore the distinctions between two types of bank cards: debit cards and credit cards, highlighting their features and functionalities. Debit cards are directly linked to your bank account, providing easy access to your funds without incurring interest charges. Each debit card is secured with a unique Personal Identification Number (PIN), allowing you to withdraw cash from ATMs or make purchases as long as you have sufficient funds.

In contrast, credit cards, typically issued by banks, enable you to make purchases with the promise of repaying the borrowed amount. Cardholders must settle their outstanding balance by the end of each billing cycle; if unable to pay the full balance, a minimum payment is required, which incurs interest charges. Additionally, credit cards offer opportunities to earn rewards based on spending habits and can be used to book airline tickets, making them a convenient choice for travel-related expenses.

Differences Between Debit Card And Credit Card:

Compare the features of debit cards and credit cards to find the best fit for your financial needs.

| Feature | Debit Card | Credit Card |

| Linked to | Personal bank account | Financial institution (e.g., bank) |

| Payment Method | Uses available funds in bank account | Borrowed money with repayment obligation |

| Interest Charges | No interest charges | Accrues interest on outstanding balances |

| ATM Withdrawals | Allows cash withdrawals from bank account | Cash advances with associated fees |

| Annual Fees | May have annual fees that vary by bank | May have annual fees |

| Fraud Protection | Limited protection depending on bank policies | Generally offers comprehensive fraud protection |

| Rewards | Few to none | Often offers rewards programs for spending |

| Payment Flexibility | Limited to available balance in account | Offers ‘buy now, pay later’ with minimum payments |

| Online Bill Payment | Can be used to pay bills online | Enables online bill payments |

What is a Debit card?

Debit cards provide direct access to your personal bank account, allowing you to manage your funds without incurring interest charges. Each debit card is protected by a Personal Identification Number (PIN) for added security during transactions. With a debit card, you can withdraw cash from ATMs or make purchases, as long as sufficient funds are available in your account. You can also check your account balance and access your account statement at an ATM, as well as transfer money between banks. Additionally, debit cards offer features like requesting bank statements and ordering a cheque book.

Key features of a debit card:

Key features of a debit card include its direct linkage to your bank account, providing fraud protection, low risk and convenient cash withdrawal from ATMs.

- Withdraw Cash: Easily withdraw cash from the ATM anytime.

- Check Balance: View your account balance directly at the ATM.

- View Account Statement: Access your transaction details effortlessly.

- Transfer Money: Transfer funds between your accounts or to another bank.

- Deposit Funds: Some ATMs allow you to deposit cash or checks directly into your account.

- Change PIN: For improved security, update your Personal Identification Number.

- Order Cheque Book: Request a cheque book directly from the ATM.

Pros of debit card

Secure:

Debit cards offer the flexibility to make transactions securely, with several layers of protection in place. Your Personal Identification Number (PIN) ensures that only you can authorize transactions, enhancing account security. Banks employ advanced fraud detection systems to identify and prevent any suspicious activity, providing an additional level of security. Furthermore, online transactions conducted with debit cards are encrypted and protected, ensuring the safety of your financial information. To maintain account security, it’s advisable to review your account statements regularly, allowing you to promptly detect and address any unauthorized transactions.

No chance of getting debt:

Debit cards provide a built-in safeguard against overspending, as they restrict transactions to the available balance in your checking account, eliminating the risk of accumulating debt. This inherent limit ensures responsible spending habits and easy management of expenses, allowing for better financial tracking and control. With debit cards, there’s no chance of exceeding your means, providing peace of mind and financial stability.

Easy to use:

Debit cards offer unparalleled convenience for everyday transactions, both in-store and online, and provide easy access to your funds. They are widely accepted at ATMs and for online purchases, making them versatile for various financial needs. With a simple swipe and PIN entry, you can effortlessly make payments at shops, eliminating the need to carry cash. Plus, you can conveniently track your spending by reviewing your account statements for past transactions. In the unfortunate event of your card being lost or stolen, requesting a replacement is a straightforward process, ensuring continued security and peace of mind.

No interest charge:

Debit cards do not incur any interest charges on your checking account, making them a cost-effective option for transactions. Whether you’re making purchases or paying fees, there are no additional interest charges applied, ensuring straightforward and transparent financial management.

Cons of debit card

You are liable for any fraudulent charges:

If your debit card is stolen or misplaced and someone unauthorized uses it, you are generally responsible for any charges incurred. In such cases, it’s important to promptly report the incident to your bank and follow their specific policies and procedures for addressing fraudulent charges. By adhering to these guidelines, you can mitigate potential financial losses and ensure that appropriate actions are taken to safeguard your account.

Other Charges:

Debit cards may have annual fees that vary by bank and account type. Each financial institution establishes its own fee structure, and some may impose maintenance fees. Additionally, using ATMs outside your bank network can incur charges, and making purchases in foreign currency might result in foreign transaction fees. It’s also important to be aware of potential overdraft fees if you spend more than your account balance. Other possible fees include replacement card fees and balance inquiry charges at ATMs. Reviewing your bank account terms and conditions is crucial to understand all potential charges.

Free Debit Card Service Available at HBL Bank! Click Here to Learn More!

Click here to access HBL Debit Card serviceWhat is a Credit card?

A credit card, typically issued by a financial institution like a bank, allows you to make purchases with the understanding that you’ll repay the borrowed amount. Cardholders are generally required to settle their outstanding balance at the end of each billing cycle. If the full balance cannot be paid, a minimum payment must be made, which is subject to interest charges.

Credit cards often provide opportunities to earn rewards and benefits based on your spending habits, helping you maximize financial advantages. Additionally, credit cards can be used to book airline tickets, making them a convenient option for travel-related expenses.

Key features of Credit card:

Key features of a credit card include its independence from directly linking to a bank account, enabling buy now, pay later’ functionality with the option to accrue interest on outstanding balances. Additionally, credit cards facilitate online bill payments and often provide rewards programs for users.

- Buy Now, Pay Later: Immediate access to purchases with deferred payment.

- Interest Charges: Potential interest if not paid in full by the due date.

- Pay Online Bills: Conveniently manage and pay your bills online.

- Rewards: Earn rewards for using the service.

- Book Airline Tickets: Flexible payment options for travel bookings.

Pros of Credit card

Rewards points:

Credit cards offer rewards points and benefits, accruing points with each purchase, often with a sign-up bonus upon acquisition. Cardholders also receive annual rewards and bonuses. Additional perks include discounts on various merchants or categories such as clothing, food, and movie tickets, as well as temporary promotions. Moreover, credit cards provide hotel benefits, enabling users to book upgraded rooms using card benefits

Credit building:

Banks or other financial institutions provide credit card bills promptly, assisting in the creation of a positive payment history. This, in turn, helps build a strong credit history, enhancing your eligibility for loans. It’s crucial to pay bills on time and regularly monitor your credit history, staying in touch with your lender to ensure financial health and responsible credit management.

Fraud protection:

Your credit card is equipped with robust security measures to protect your financial transactions.

- CVV (Card verification values) that 4-digit code on the back of your card adds an extra layer of security.

- Only you know your PIN (Personal identity number) code.

- Any doubtful transaction is detected you may receive notification.

- Credit card may have sent a verification code to your phone or email for two-factor authentication.

International travel benefits:

When traveling internationally, credit cards offer a range of valuable benefits. Firstly, they eliminate the need to carry foreign currency, providing convenience and security throughout your journey. Additionally, credit cards come equipped with robust security features, minimizing the risk of fraud during overseas transactions. Moreover, cardholders can enjoy discounts at international hotels, enhancing their travel experience while saving on accommodations. Another advantage is the absence of foreign transaction fees, allowing travelers to avoid extra charges when making purchases abroad. Furthermore, credit cards often provide insurance coverage for luggage, offering peace of mind in the event of loss or damage during travel.

Cons of Credit card

High-interest rate:

If you fail to pay your credit card balance in full, you will incur charges. These charges can accumulate rapidly due to the high-interest rates associated with credit cards, potentially leading to financial strain in the future. Additionally, the burden of high-interest payments may pose challenges, making it difficult to manage your finances effectively. Therefore, it’s essential to prioritize timely payment of your credit card balance to avoid these adverse consequences and maintain financial stability.

Overspending:

Buying items impulsively without considering their cost is a common pitfall of credit card usage. It’s important to exercise restraint and carefully assess your purchases to ensure they align with your budget and financial goals. While credit card rewards can be enticing, it’s essential to weigh them against potential costs and fees associated with overspending. Therefore, it’s crucial to adopt a mindful approach to your spending habits, prioritizing responsible financial management to avoid unnecessary debt and maintain financial well-being.

Fees:

Credit cards often come with a range of fees that cardholders should be aware of. These fees include annual fees, which are charged for maintaining the card membership and can vary depending on the card’s benefits. Additionally, if you carry a balance on your credit card and fail to pay it off by the due date, you’ll incur interest charges. Late payment fees may also apply if you miss making at least the minimum payment on time. Furthermore, some issuers may charge a fee if you request a copy of your credit card statement. Being mindful of these fees and managing your credit card responsibly can help you avoid unnecessary costs and maintain financial stability.

Complex terms:

Understanding the terms and conditions of credit cards can be challenging due to various factors. Hidden fees may lurk within the fine print, necessitating scrutiny to avoid unexpected charges. Moreover, deciphering complex rewards programs and earning points can be confusing for cardholders seeking to maximize benefits. Additionally, navigating through credit card statements, often filled with unfamiliar terms and intricate billing details, can add to the confusion. To effectively manage credit cards, it’s crucial to diligently read and understand the terms, regularly monitor statements, and seek clarification when needed to avoid misunderstandings and financial pitfalls.

Here are some guidelines to follow if you are a credit card holder:

- Make a budget

- Review your credit history weekly or monthly.

- Avoid unnecessary spending.

- Avoid shopping when you are emotional.

- Use credit cards only for necessary expenses

- Prioritize saving and emergency funds.

- Use credit card when needed or in emergency case

- Practice mindful spending and consider long-term consequences.

- Avoid balance transfer.

- Make timely payments.

Free Credit Card Service Available at Standard chartered Bank! Click Here to Learn More!

Click here to access Standard chartered Credit Card serviceFAQs About Debit Card And Credit Card:

Is a credit card good or bad?

Credit cards can be a beneficial financial tool when used wisely. They help you build a positive credit history and earn rewards on your purchases, while also offering additional benefits. However, it’s important to be cautious because using credit cards irresponsibly can lead to debt and higher interest payments.

What is CVV in a debit card?

The CVV (Card Verification Value) on a debit card is a security feature designed to reduce fraud and enhance the security of online and phone transactions. It is a three-digit number typically found on the back of the card, near the signature strip. This code helps verify that the person making the transaction has physical possession of the card, adding an extra layer of protection against unauthorized use.

Is a debit card considered interest-free compared to a credit card?

A debit card is generally interest-free because it allows you to spend only the money you have in your bank account. Unlike credit cards, which let you borrow money and charge interest if you don’t pay your balance in full by the due date, debit cards simply deduct funds directly from your checking or savings account.

So, if you’re looking for a way to manage your spending without accruing interest, a debit card is a great option! Just make sure to keep track of your balance to avoid overdrafts.

Summary and Final Thoughts on Debit Card And Credit Card:

While both bank cards offer convenience in managing finances, debit cards emerge as the preferable option for individuals across various demographics, including students, housewives, teachers, and business owners. Debit cards provide immediate access to one’s own funds without the risk of accruing debt or high-interest charges. On the other hand, credit cards primarily serve as tools for building credit history and earning rewards points. However, the drawback of credit cards lies in the potential for overspending and accumulating debt due to high-interest rates. Therefore, it’s crucial for credit card users to exercise disciplined financial management by paying their balance promptly to avoid falling into debt traps. Ultimately, the choice between both bank cards, depends on individual financial goals, spending habits, and risk tolerance levels.

We hope you found this information valuable! We’d love to hear your thoughts—share your feedback in the comments below and let us know how we can assist you further.

Please Write Your Comments